Send money on the spot

Online account directly from the app

Are you the only one in your group of friends who's still not at BT? No excuses now. You can open an online banking account directly from BT Pay.

And one more thing: if you get a Star card, you can request one with the same benefits for someone you care about—even if they are not a BT customer.

In addition, you will receive 150 lei in Star pointsuntil March 10.

All cards, no worries

Your debit, credit and virtual cards all a tap away.

Credit 100% ONLINE

Apply for a personal loan directly from the app.

Put money aside easily

Save easily for the things you want, benefiting from a monthly progressive interest rate depending on the amount in your account.

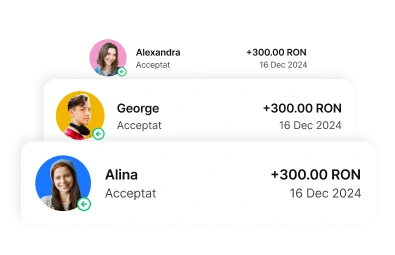

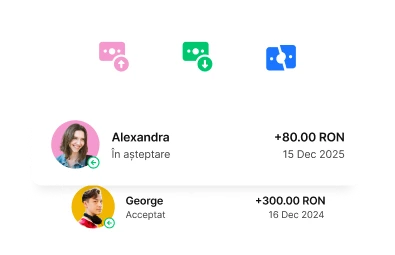

Instant transfers

Whether you split the bill with friends or pay with your phone, all your transactions are just a click away.

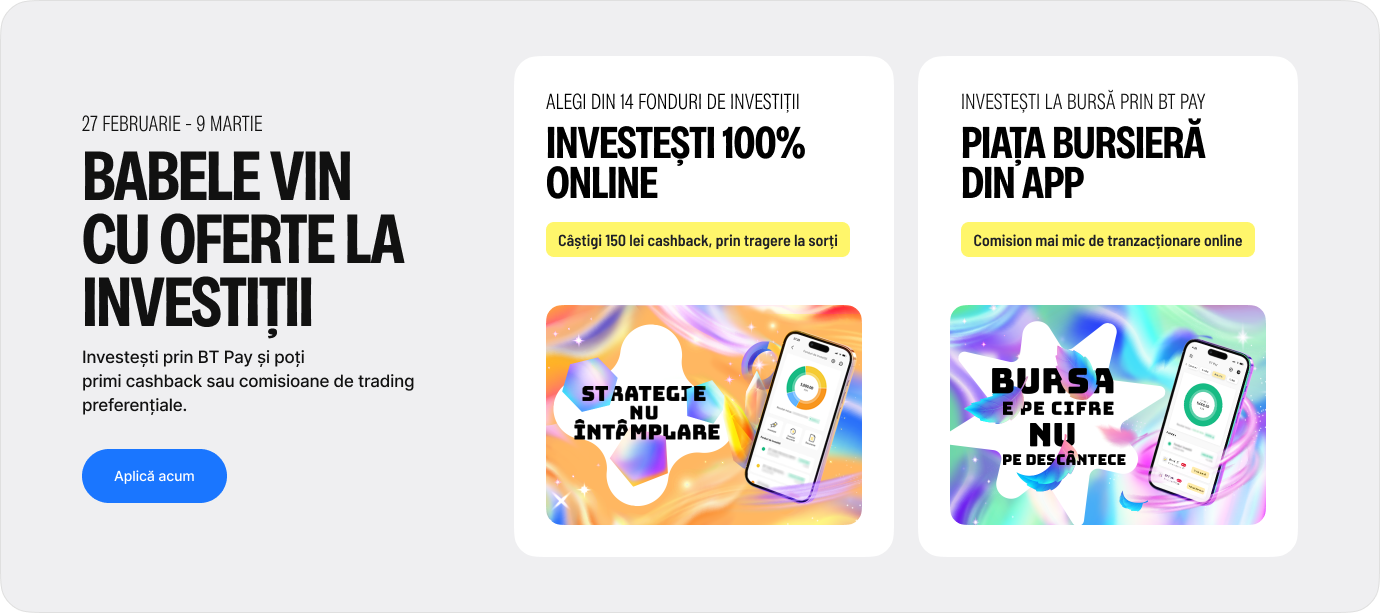

Investments just a click away

With over 14 investment funds in BT Pay, you can start investing instantly without having to be a financial guru.

Choose your banking subscription

Different people, different needs. So you have five subscription options to choose from. ✨

Interbank collections with ZERO commission Mobile banking with BT Pay

Interbank collections with ZERO commission Mobile banking with BT Pay Free travel insurance

Interbank collections with ZERO commission Mobile banking with BT Pay Accident insurance from Metropolitan Life Insurance

Access to business lounges in Bucharest and Cluj-Napoca airports Free travel insurance Mastercard Gold

Insurance from Metropolitan Life Insurance Mastercard Gold Priority in the Call Centre

Make your way in BT Pay

If you are a resident in Romania and are 18 years old, you can open your account online in less than 10 minutes. All you need to do is download the app, confirm your identity with your ID and choose the current account subscription that suits you.

One app for every situation

RAPID HELP

In order to open an online account through BT Pay in Romania, you must have an identity document issued by the Romanian authorities, namely a CI (standard identity card) or EC (electronic identity card). 😁

No. To open an account online and sign the contract remotely, you must be at least 18 years old.

If you are under 18, we expect you to visit one of our branches with a parent to open an account.

From absolutely anywhere in the world! 🌍

You just need to be over 18, download the app, and have your ID with you. ✨

About 5-7 minutes, just as long as it takes to listen to 2 favorite songs from your playlist. 🌟

ZERO account and card opening and management fees. ✨

However, depending on the current account subscription selected, additional monthly fees may apply.

Yes! 😊 Once you have opened an account and received approval notification, you can instantly use BT Pay and your digital card.

open account 100% online

In about 10 minutes, via the BT Pay app, you have a lei account with us and can use your card instantly from the app. It takes as long as listening to two songs.