The first nine months of 2018 for Banca Transilvania: Continuous support for the economy and population, in the context of the final integration of Bancpost

13 November 2018 Reading time 4:00 minutes

Banca Transilvania is nearing the completion of the integration of Bancpost, and at the same time, BT remains a strong pillar of financing the national economy by lending to companies and the population.

- The bank has exceeded the 550,000 credit customers threshold, of which more than 30,000 are companies. The merger with Bancpost, which will take place on 31 December this year, will add more than 175,000 credit customers to BT's portfolio.

- In the third quarter of this year, Banca Transilvania granted approximately 55,000 loans to companies and individuals.

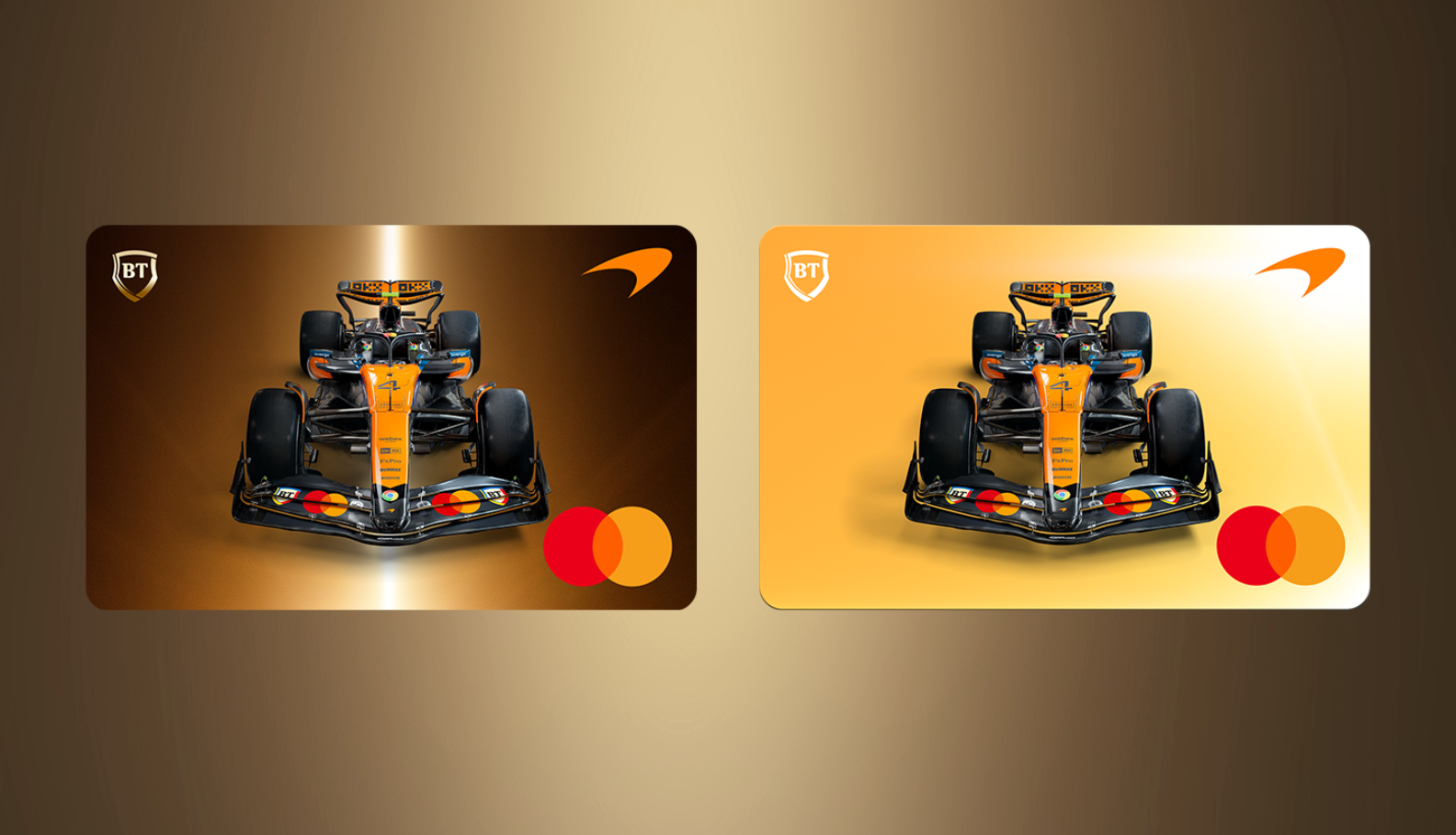

- The bank reached 3.2 million cards in its portfolio, which means 19% market share of cards issued in Romania.

- BT is the main one for merchant transactions in Romania. The number of POS terminals managed by Banca Transilvania reached 47,000, representing 24% of the terminals installed in Romania.

- The bank manages a portfolio of approximately 410,000 credit cards, which generate about 30% of credit card transactions at merchants in Romania.

The consolidated net profit of Banca Transilvania Financial Group is RON 1,241.07 million, of which the bank's net profit is RON 979.06 million. The result includes part of the Bancpost integration expenses in BT. Subsidiaries and equity holdings contributed more than 260 million lei to BT Group's profitability.

"We are pleased that we have been able to combine organic growth and profitability with a rapid process of integrating Bancpost's business and customers. Our priority has been and remains our customers' experience in using banking services and financing the economy. That is why we focused on responsible business growth and investments in technology and digitalization. We opted for a fast integration of Bancpost because it is to the advantage of our customers as well as to foster growth. Everything is going well and we are confident about the merger at the end of the year. The growth of BT's customer base due to the customers we expect from Bancpost is yet another premise for the further development of our bank in 2019" - says Ömer Tetik, CEO, Banca Transilvania.

BT Financial Group, results in the first nine months:

- Banca Transilvania Financial Group has total assets of 76.6 billion lei, of which 64.7 billion lei BT individually, with net loans representing 50.2% of BT Group assets;

- The Group manages 38.43 billion lei of loans in Romania, of which 32.51 billion lei are granted through Banca Transilvania.

- Customer deposits reached 62.79 billion lei, of which 41.38 billion lei are deposits of individual customers and 21.41 billion lei are deposits of legal entities.

- BT's loan-to-deposit ratio was 66% at the end of September 2018.

- BT's operating efficiency remains at a comfortable level of 47%, despite the large financial efforts to integrate Bancpost and Victoriabank.

- BT Leasing merged in October this year with ERB Leasing, a company acquired from Eurobank Group together with Bancpost and ERB Retail Services in April this year.

Technologies and digital

- Applytia BT Pay - the first bank wallet in Romaniaania, launched at inceptof this year - has reached 180,000 descarcari at the end of this quarter. Numarul tranzactiilor cu telefono la comercianti si al transferurilor de bani intre utilisateurs a crescut cu 33% fata Q2 2018.

- BT signed in October this year a digitisation partnership with Druid and UI Path. BT has become the first local company to use integrated automation and artificial intelligence technologies for a program aimed at more than 7,000 employees, based on artificial intelligence.

- Banca Transilvania has launched the first non-banking solutions platform for SMEs, BT Store, offering its customers access to preferential offers. The solutions are aimed at business management and administration and solve real business needs - from invoicing, primary accounting, cash flow management, to employee recruitment etc.

- The PAGO application, which centralizes all utility bills in a single account and which is developed in partnership with BT and supported by Mastercard, has at the end of September this year more than 150,000 downloads.

- BT has launched the Meal Card, the digital version of printed meal vouchers. It is intended for food purchases and restaurant payments in the bank's partner network. In addition, the card can be included in the BT Pay app, offering the best user experience of any offering on the market.

Other financial information:

- The non-performing exposure ratio according to the EBA indicator is 5.74% as at 30 September 2018.

- The total provision coverage of non-performing exposures according to EBA standards is 88%. If guarantees are taken into account, the coverage ratio is 119%.

- The bank's solvency is 23.16%.

Press contact

Other articles

A little more

I just sent an email to you. Confirm your subscription by clicking on the link in the email.