0%

Subscribe to news

You can unsubscribe anytime you want, learn more.

PRESS CONTACT

comunicare@btrl.ro

OTHER ARTICLES

February 4, 2026

BT Broker de Asigurare begins its nationwide expansion through its own franchise network

January 30, 2026

BT obtains a maximum rating for the communication with investors in 2025, both as a stock issuer and as a bond issuer

January 29, 2026

BT Pay, 8 Years from Launching: Digital Ecosystem with over 4.6 Million Users

January 22, 2026

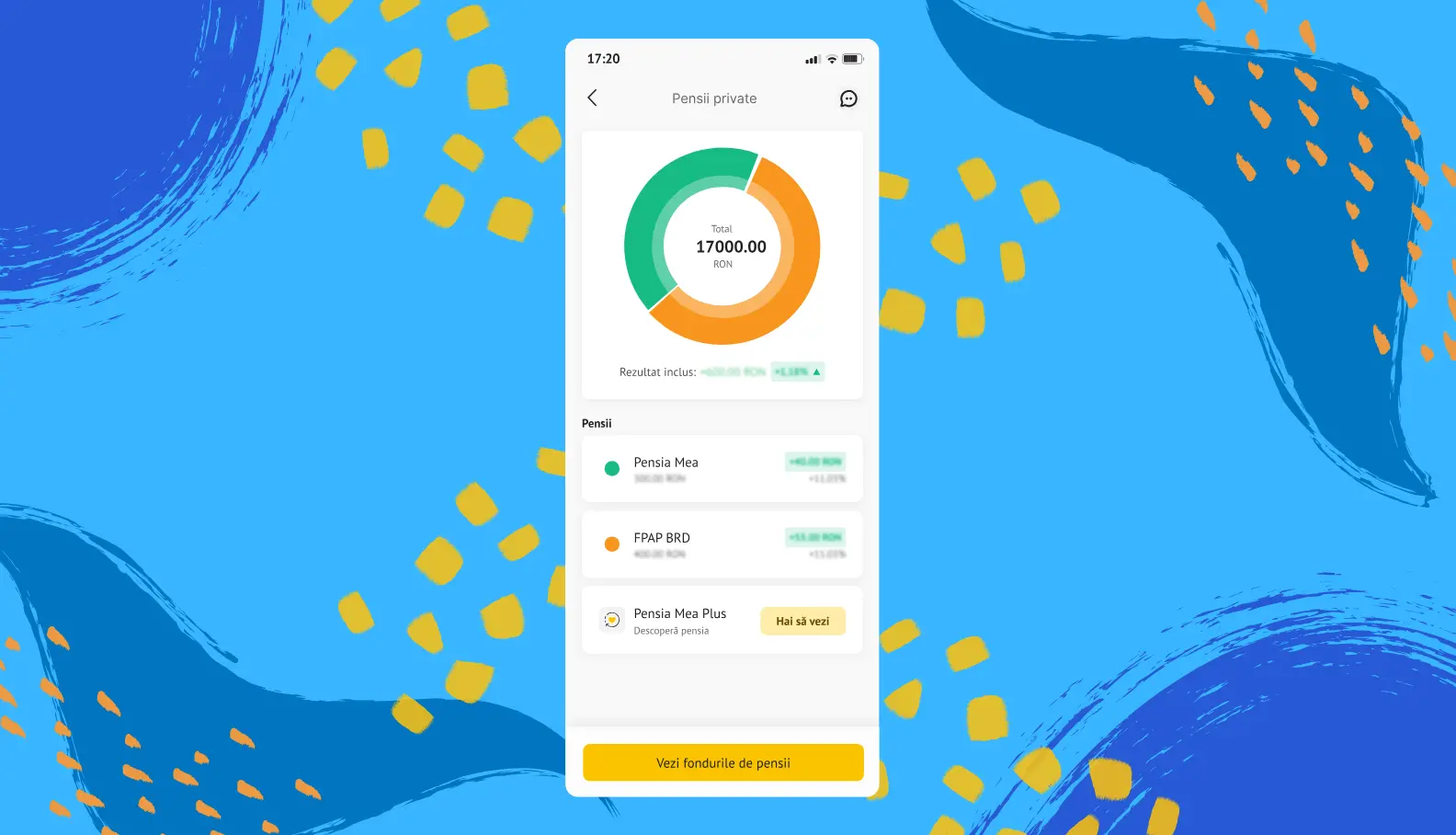

BRD Pensii customers, part of Banca Transilvania Group, can access information about their savings in the Pillar 2 pension fund in BT Pay.