NOU100.000 de lei pentru planurile tale?

Aplica pentru credit online direct din BT Pay.

This page is automatically translated from Romanian into English.

Scanează codul QR și descarcă aplicația

Aplica pentru credit online direct din BT Pay.

Faci totul de pe telefon, din confortul casei tale sau cât aștepți să ți se livreze pizza. Îți punem banii în cont, iar tu te ții de planurile tale. ☺️

📍Bine de știut: pentru a lua în calcul cererea ta, e important să ai datele actualizate în BT Pay și veniturile salariale declarate la ANAF.

Cum funcționează?

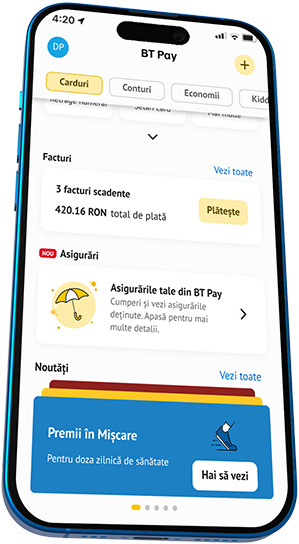

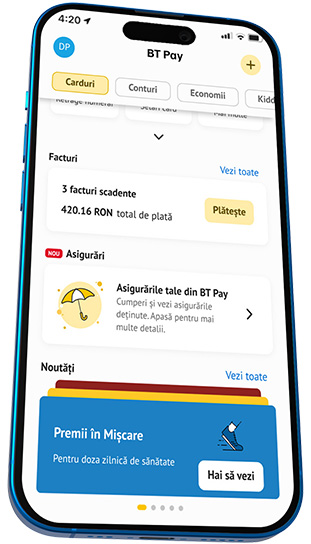

Intri în BT Pay, completezi câteva informații despre tine și nevoile tale, noi îți comunicăm oferta, semnezi și asta-i tot. ☺️

Totul durează cât ai asculta 2 piese, oricând, oriunde, 100% online

Poți să devii client BT oricând 🥰. Trebuie doar să îți descarci BT Pay și să ne spui câte ceva despre tine. Totul se face 100% online, direct de pe telefon... și nu e nevoie de videocall.

După ce treci prin toți pașii poți folosi BT Pay pe loc, fiindcă ai deja cardul digital. Și da, chiar durează cât 2 piese.

Nu e nevoie să te oprești din conversație sau să închizi alte aplicații

Ai ajuns la casă? Doar deblochezi telefonul și-l apropii de POS, fără să deschizi app-ul. Unlock & Pay*, rapid și simplu, fără PIN. Și fără comision. Descoperă toate modalitățile de plată în setările aplicației.

*Poți plăti cu telefonul dacă ai funcția NFC disponibilă pe Androidul tău. Dacă ai un Apple, cu un singur click îți trimiți cardurile din BT Pay în Apple Wallet și plățile cu telefonul sunt la fel de simple.

Soluția perfectă pentru banking-ul la distanță

Și mai ușor de confirmat ca niciodată

Una pentru tine, una pentru afacerea ta

În curând, vei putea face banking de pe telefon folosind doar 2 aplicații: BT Pay (pentru persoane fizice) și BT Go (pentru pesoane juridice). Lucrăm constant la aceste aplicații, astfel încât să fie singurele de care ai nevoie pentru banking de zi cu zi. BT Pay și BT Go vor înlocui treptat NeoBT și BT24. Hai aici să vezi mai multe.

Telefon, portofel, chei, căști. Check list-ul de plecat de-acasă e făcut, dar știi la ce poți renunța? La portofel, n-ai nevoie de el atunci când ai BT Pay

BT Pay e your all in one app pentru viața de zi cu zi.

Plătești taxi cu cardul, scoți bani de la ATM doar cu telefonul, îți faci asigurare pentru city break-ul viitor sau plătești factura la curent. Toate astea and even more, cu BT Pay. Posibil să nu realizezi cât de mult îți poate ușura viața o aplicație de banking, așa că hai să-ți povestim pe rând, despre funcționalitățile BT Pay.

BT Pay te salvează chiar și când ai nevoie de o plasă de siguranță

Direct pe telefon sau prin IBAN, dintr-o mișcare

Un fel de workout plan… dar pentru banii tăi: investește pe loc, direct din app

Ai putea să mai zici de câteva ori că vrei să începi să investești sau ai putea să investești, direct din BT Pay.

Da, chiar ai nevoie doar de BT Pay ca să investești. Ai la un click distanță 14 fonduri de investiții în RON, EUR și USD, cu diferite grade de risc și randamente potențiale. Poți vedea detalii despre randamentele fiecărui fond, principalele dețineri și moneda.

Una dintre cele mai bune părți e că poți seta plăți recurente – adică știi sigur că te ții de planul de a investi lunar.

Intră în lumea magică a UNTOLD cu cardul virtual dedicat, ce îți aduce numeroase beneficii

Cu doar câteva tap-uri plătești facturile de utilități

În plus, îți poți majora linia de credit de pe overdraft pe loc

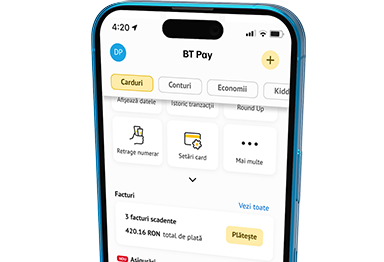

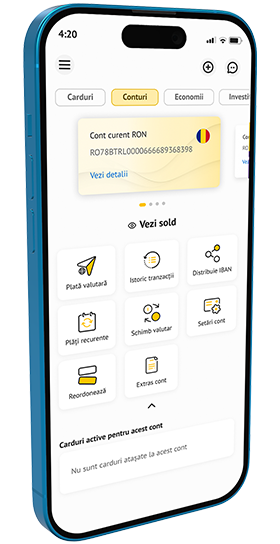

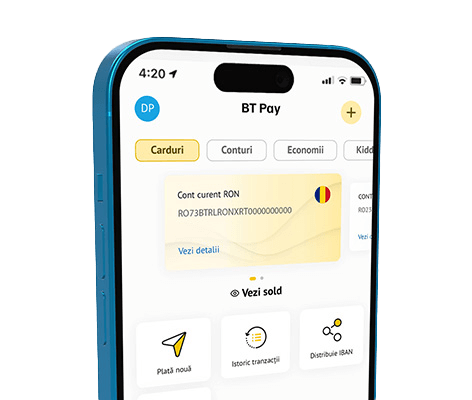

Din tab-ul Conturi de pe homescreen-ul aplicației BT Pay ești în control deplin când vine vorba de conturile tale: îți poți redenumi sau reordona conturile, vezi soldul și istoricul tranzacțiilor, ai la îndemână extrasul de cont, setezi plăți recurente, îți deschizi conturi în mai multe valute și poți face schimb valutar sau plată valutară.

BT Pay

BT Pay

Alege un multiplu de rotunjire: 1 leu, 5 lei sau 10 lei. Pentru fiecare plată pe care o faci cu cardul tău de debit, vei economisi fără să-ți dai seama suma rămasă până la multiplul ales. Banii ajung în contul tău de economii Round Up care are și dobândă.

Te invităm să afli mai multe aici.

Poți să îți faci polița de asigurare RCA, direct din aplicație. Totul se face online, în câțiva pași simpli. Prima dată trebuie să alegi una dintre ofertele din BT Pay și să încarci documentele necesare.

După care urmează să primești polița direct pe mail.

Află mai mult

Be safe

All the way

Astfel, poți avea bani numerar când vrei: generezi un cod pe care îl folosești la orice ATM BT și ai pe loc cash.

Pentru că telefonul e noul portofel. 🥰

Decât să uiți de asigurarea de călătorie, mai bine o faci din timp: direct din app, pe 1 an întreg.

E disponibilă atât pentru călătorii în România, cât și în străinătate. Completezi câteva informații despre tine și despre cum îți place să călătorești, iar noi găsim varianta optimă pentru tine.

Află mai mult

Let’s do thiiiis! ✈️

Cardul virtual e aproape ca orice alt card de debit, numai că îl vezi instant în BT Pay și îl folosești direct din app. Nu îl primești și fizic. E un card cu design premieră în Europa, perfect pentru plățile online sigure, mai ales atunci când vrei să plătești pe un site cu un anumit card. Îți poți emite cardul în lei, euro sau dolari.

Află mai mult

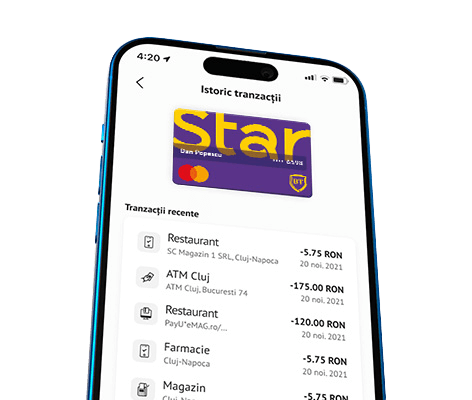

Conturile tale, controlul tău

Poți afla soldul, istoricul tranzacțiilor, inclusiv creditările din cont. Inițiezi transferuri în lei, transferuri între conturile proprii, de debit sau de credit și poți seta plăți recurente din conturile tale curente.

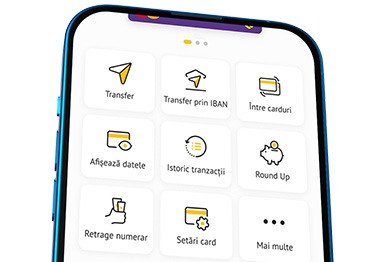

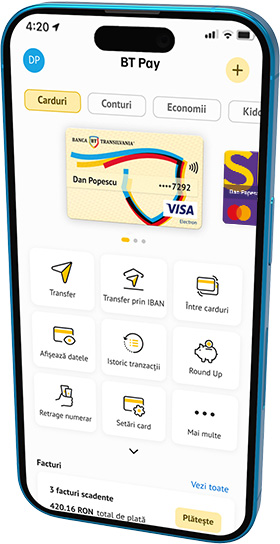

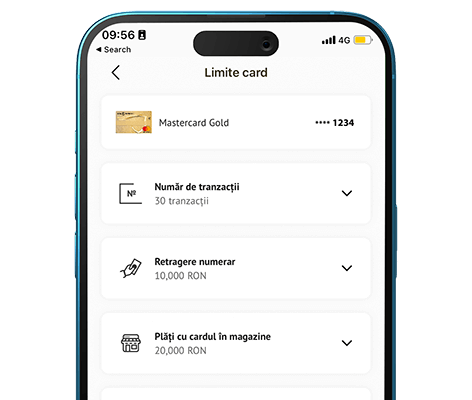

Ai control asupra cardurilor

Modifică limita tranzacțiilor tale online și offline, a retragerilor de numerar de la bancomat și a numărului de tranzacții pe care le poți face într-o zi. În plus, poți bloca sau debloca cardurile, oricând ai nevoie.

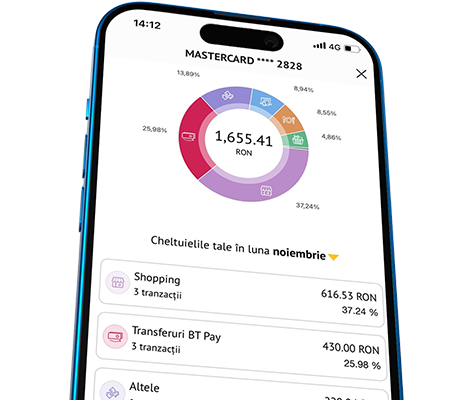

Grafic de cheltuieli

Pentru fiecare card în parte ai un grafic al cheltuielilor tale, pe domenii: utilități, supermarket, transport, timp liber etc. Astfel îți va fi mai ușor să știi unde poți economisi.

Totul din app,

în timp real

Trăiește momentul, chiar și când faci banking. Află în orice moment cum stai cu banii, pe ce i-ai cheltuit și când. Totul – din câteva atingeri.

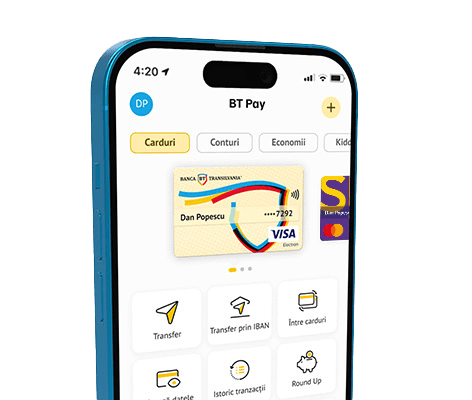

Activezi aplicația fără drumuri la bancă

Descarci gratuit aplicația, adaugi cardurile tale BT, chiar și cardurile Business și non-BT și ești pregătit de #EasyBanking.

Cât te costă? Accesează lista taxelor și comisioanelor.

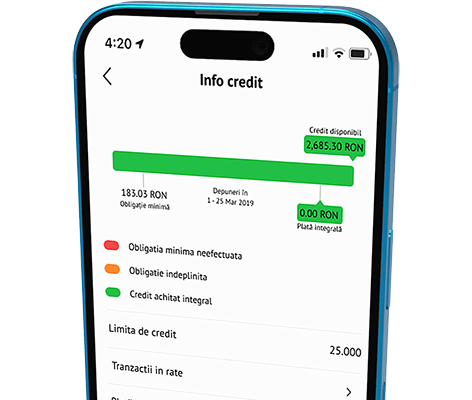

Gestionezi cardul de credit

Află totul despre el: care e data scadenței, care e suma minimă de plată, cât e dobânda. Poți alege dacă vrei să plătești întreaga sumă sau doar o parte, automat sau manual, la data scadenței sau mai devreme.

În plus, graficul te ajută să vezi exact care e balanța și obligațiile de plată.